About b.yond

Create, innovate, enable

b.yond is a turnkey financial innovation platform created by combining the expertise of trusted and proven organisations.

b.yond enables fintechs and digital banks to go to market quickly and simply with a white-label solution. Demonstrate and test your POC, without compromising on the quality of your value proposition.

b.yond is better banking for all.

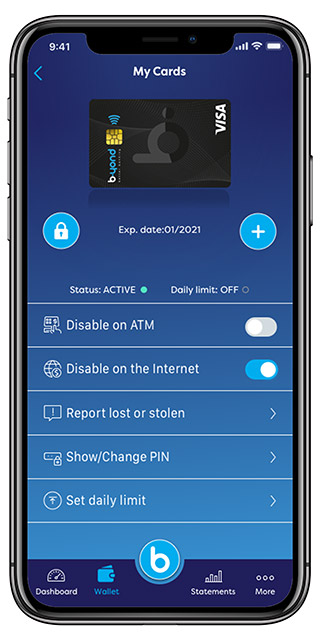

b.yond allows you to launch a number of cards and wallet accounts in an MVP capacity.

Choose from a range of options regarding:

• Scheme connectivity on debit and prepaid rails

• BIN sponsorship – UK and Europe

• White-label options

• Accelerated card manufacturing

• Off the shelf app with slick UX

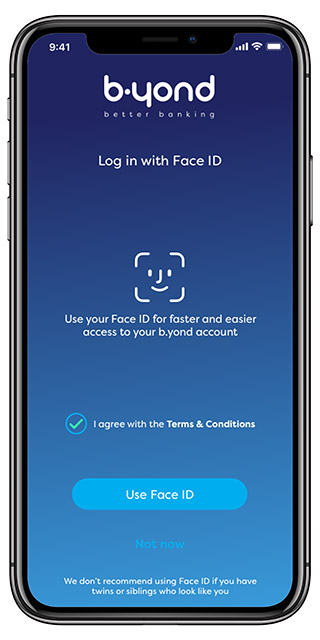

• User on-boarding with full KYC

• Funds loading and payout in UK & Europe

b.yond ecosystem

Accelerated MVP launchpad

Making the complex simple with

one contract + one ecosystem

b.yond eliminates the complexities associated with launching a payment value proposition with speed to market by providing one aggregated service offering and one simplified commercial agreement.

You also benefit from working with the organisations leading the Fintech revolution.

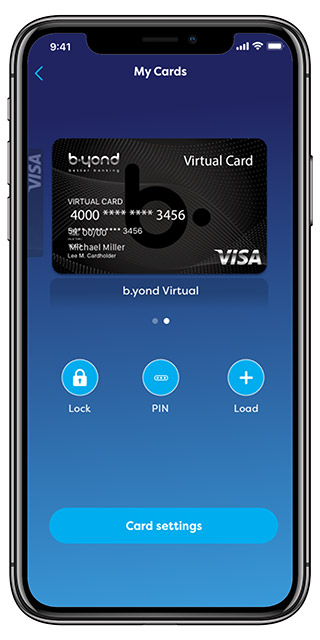

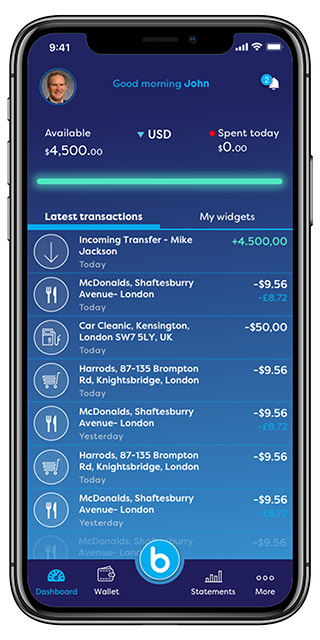

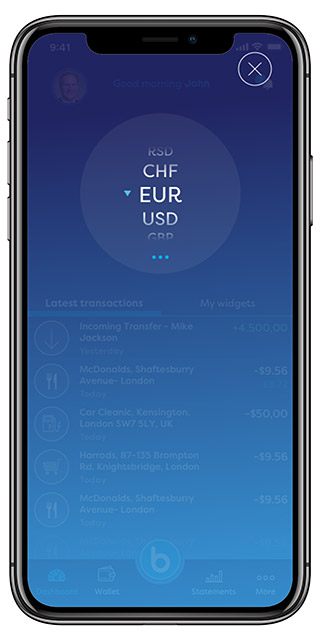

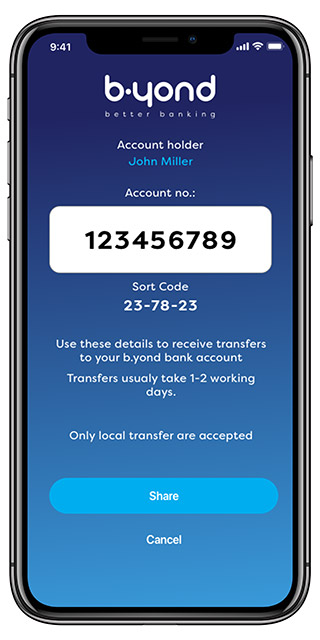

Multi-platform

Digital banking across all your devices

b.yond is optimised to enable clarity of transactions ensuring you’re always in control.

b.yond delivers a digital banking platform across all devices. You can shape your customer experience with the knowledge that your design will be received as intended and that your users will have access to LaunchPad on their computer (web app), smart phone (mobile app) or tablet (responsive web app). Our system ensures the customer receives the rich experience you intended them to have using intuitive interfaces and native design.

Features

Enhance the user experience

Features

Additional features

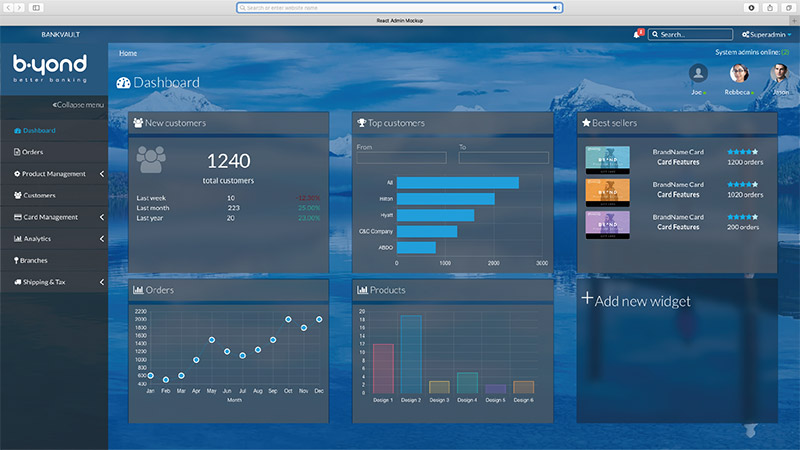

Control centre

Monitor and track performance

b.yond’s analytics suite gives you a clear vision of your product’s performance and your customer’s behaviour. Real-time analytics give you an immediate view, with the flexibility to adapt and move digital data to enhance product performance.

Premium Plans

Scale your launch

-

Starter | 100 cards

• b.yond Mobile/Web Apps

• Card Wallet Top-Up*

• Free transactions*

• Card Management

• Spending Analytics, Filters and Controls (incl. Real-time dashboards)

• SMS Device Verification*

• (e)KYC and AML checks*

• Fraud Detection/Prevention

-

Professional | 500 cards

All the features of Starter plan (+)

• FasterPayments/SEPA Top-Up*

• Card PIN Selection

• PSD2 Compliant 2-factor Authentication

• Multi-Language -

Advanced | 1000 cards

All the features of Starter and Professional plans (+)

• ApplePay/GooglePay Top-Up*

• Free ATM withdrawl*

• Free International Transactions

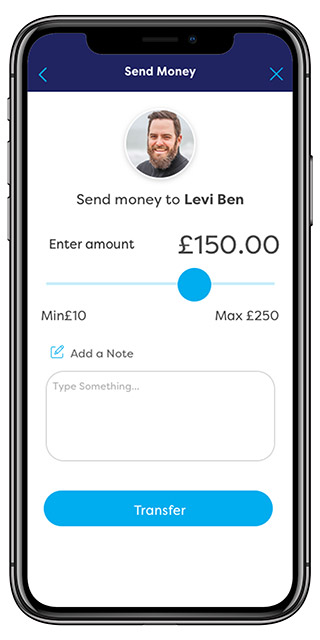

• Peer-2-Peer Transfer

• Multi-FX*

• ApplePay/GooglePay Wallet Integration

• Chat Function

• Widgets (inld. Nearest ATM and Forex rates) -

Ultimate | 3000 cards

All the features of Starter, Professional and Advanced plans (+)

• Expense Management – Claimant

• Expense Management – Approver/Admin

• Product training

• Advanced integrations

Wearables and Branded Mobile/Web Apps are available as optional extras

*Subject to limits. All plans are subject to minimum contract terms of 6 months

Roadmap

b.yond, the financial innovation platform

|

Signup & KYC |

||

|

P2P transfer |

||

|

Card control |

||

|

Agency Banking |

||

|

Physical & Virtual cards |

||

|

Statements |

||

|

Alert notification |

|

Account load |

||

|

Multi FX |

||

|

Chat Support |

||

|

Savings Pots |

||

|

Tokenisation |

|

Multi language |

||

|

Rewards & Cash-back |

Contact

Get in touch…

![]()